USE CASE

How AICORIS Works in the Real-World

PROCUREMENT

____

In this video the existing process touches three different software systems, for which an employee takes many minutes to complete each transaction manually. The human being is able to complete a few hundred transactions each day with the possibility of a few errors. Here we automated over 100 steps of the process and have a software robot run it seamlessly all day, thus processing thousands of purchase orders – saving the client time and relieving a human being of mundane, repetitive work which allows him to focus on more meaningful or creative tasks.

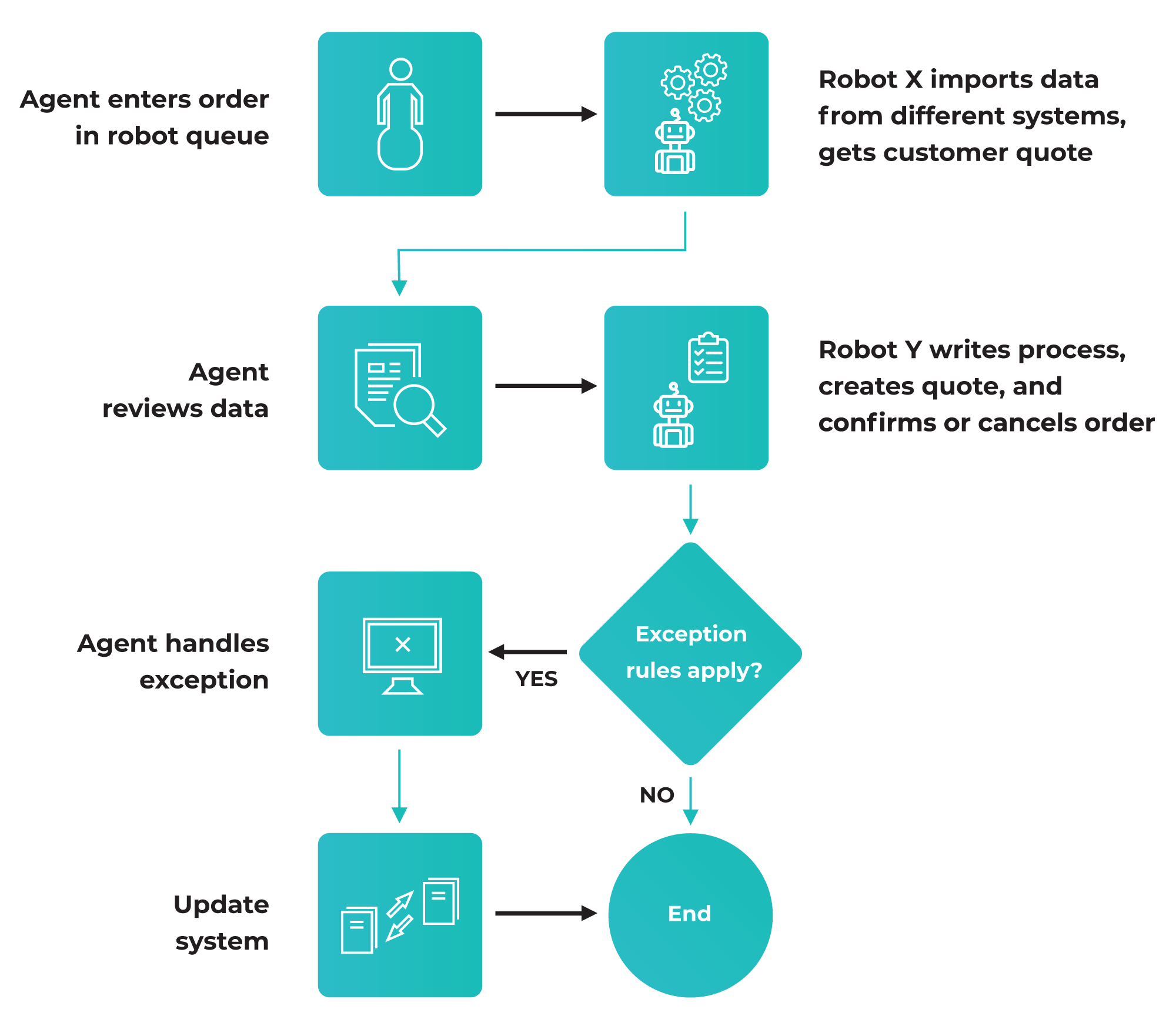

Sample flow for process automation

____

BUSINESS LOAN AUTOMATION

____

In banks worldwide, one of the key businesses is credit issuing. As you may expect, there are multiple processes involved in authorizing a bank loan to a customer. As an example, we will go through a business loan scenario and how it can be automated:

1. Analysis

In this first step, we work with the bank to understand the bank’s business processes involved in loan processing. This would include user-interviews and a review of the multiple systems involved. Typically, there would be a CRM system, a loan processing system and a core banking system involved. The analyzing team looks for data about turn-around-time and time taken during each step of any manual process involved. The team identifies opportunities for digitization, efficiency gains, automation and also checks opportunities for technology updates (such as DLT). Together with the customer, we then define the goals and chart out a roadmap for digitization from end-to-end. A clear articulation of ROI and benefits will be available at the end of this phase.

2. Digitization

At the end of the Analysis phase, the opportunity for digitization would be evident and well defined. However, for the implementation of the designed roadmap, it will be required that data is available in a digitized form and in real-time. In many companies, there is still non-digitized data as well as information on paper or in other formats which cannot be read by robots or machines. Therefore, in this step, we not only work out the plan for the digital transformation specifically for the customer, at AICORIS we also implement it so that all idle data will become accessible by software robots and is ready for automation.

3. Robotic Process Automation

There are usually multiple processes involved with loan processing. In most banks, the process steps move between multiple people and departments within the bank. There is a sequence of approvals and checks before a business loan is actually sanctioned. Also, data is initially entered into a CRM system, after which manual processes take over. Once the loan processing is done, data is re-entered into other systems (like a core banking system or loan processing system). These processes will be great candidates for automation, and the overall gain for the bank will be tremendous – both in terms of time taken, as well as the overall turn-around-time for loan sanctions. There would be an increase in the overall security and predictability of response time to a customer. AICORIS implements these RPA processes for the customer within weeks.

4. Unleash the Power of Data

With thousands of loans being processed by the banks, and also significant data available about customers, the banks can benefit by using Artificial Intelligence and Machine Learning algorithms to assess the data (when digitally available) on top of RPA e. g. to better define the risk profiles of their customers or even other external market events. It even allows to have systems make decisions (like human beings do). Over a period of time, these intelligent systems learn and improve their abilities the more is automated and the more data is processed. AICORIS offers algorithms that help customers to leverage the full power of the data they have.

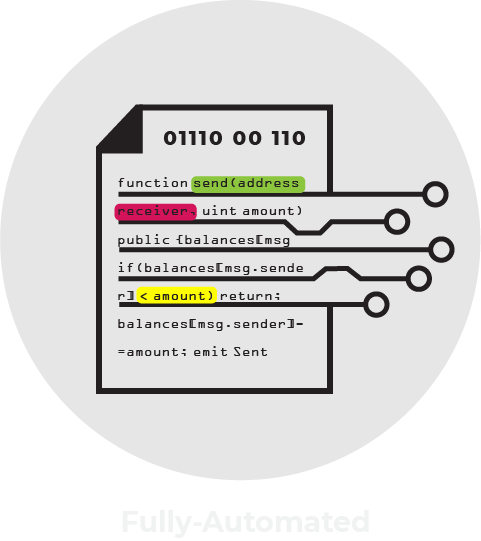

5. Blockchain Technology

Traditionally, much of the banking data and information about customers and/or financial instruments like loans are stored within the banks data silo, in relational databases. There are repeated queries from other banks, customers and other departments or institutions for information about e. g. outstanding loan amounts of customers. In that context there is also a regulatory need to keep the KYC documents updated for each customer on a regular basis. This means interaction with other data sources or their parties outside of the bank – a perfect candidate for introduction of blockchain technology. These processes can be automatically executed in real-time by AICORIS Cognitive Contracts through any system or machine in order to gain full and secure traceability of events.

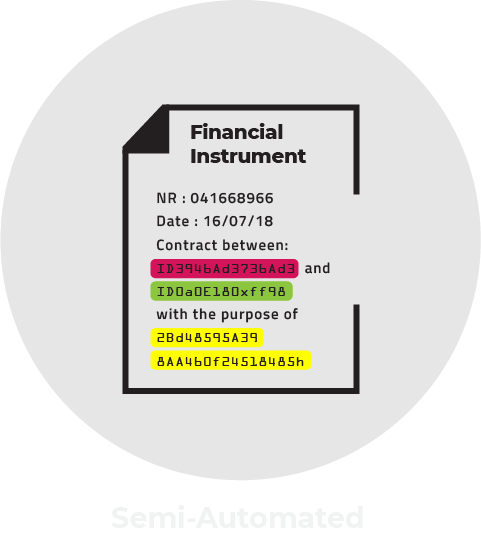

6. Cognitive Contracts

A business loan basically is a bilateral contract. In other words, it is a financial instrument and the actual execution of the intent of the contract and business logic inside it is still done by humans today. In this stage, AICORIS works with the customer to automate the business loan contract to build a financial instrument which is self-executed by software robots/machines. So, loan disbursements, closures etc. can happen through these types of Cognitive Contracts (as we call these at AICORIS). Actually, any financial instrument could be made cognitive, smart and self-executing to reduce costs as well as risks involved and to save a tremendous amount of time.

CONTRACT AUTOMATION SAMPLE

____

Copyright 2019 AICORIS

All Rights Reserved.

Website and Visuals crafted with Dedication and Care by Mayune.